No other major sport in the US combines a unique viewer experience, 2 hours of commercial-free coverage with a dynamic, young, and relatively new fandom.

This is why F1 has exploded in the US.

Let’s look at the replay tape and see how F1 transformed from a struggling racing organization in need of a cash infusion to a global entertainment powerhouse after Liberty Media's acquisition in 2016.

Before Liberty Media's takeover, F1 was experiencing a decline in viewership of about 40% and had an aging fanbase. The organization needed to modernize and attract younger viewers.

Liberty Media's CEO Chase Carey expanded F1's digital marketing and content strategy, seemingly overnight, by partnering with Netflix to create F1: Drive to Survive, a docu-series that provides behind-the-scenes access to the sport.

F1 relaxed social media rules, altered the rigid regulations to allow for more overtaking, and, most importantly, allowed drivers greater freedom to engage with fans online.

The entertainment-first approach attracted an entirely new set of fans, and F1 is now the world's fastest-growing sports league on social media. The average age of an F1 fan dropped from 36 in 2017 to 32 today; drastically lower than the MLB (57), NFL (50), NHL (49), and NBA (42).

F1's popularity in the US market was low before Liberty Media's acquisition. The organization partnered with ESPN and gave them broadcasting rights for practically free to build the sport's presence in the country. F1 races in the US are now averaging over 1.2 million viewers per race.

F1 thru its rights owner, Liberty Media, is expanding its presence in the US by investing in a 4-story, 300,000-square-foot paddock building in Las Vegas to the tune of $500 million. This is an unusual gamble for an asset-light business. Why? F1 doesn't own the cars, teams, or race tracks; instead, the venues simply pay them a fee ($30M+) to host a race each year.

F1’s success has every sport deploying its own “Drive to Survive” style strategy bump.

NASCAR has Race for the Championship.

Tennis has Break Point.

Golf, or The PGA, has Full Swing.

IndyCar's 100 Days to Indy debuted last week.

Stack up the facts and even Yoda would say “The flywheel is strong with this one.”

This padawan would challenge there is a crucial component not being discussed; the viewership experience.

While “Drive to Survive” ignited the rocket, it’s the customer experience at home that has sped up the flywheel, as it delivers something unique to keep the viewer engaged. It’s far removed from alternate American motorsports options; I’m looking at you NASCAR & IndyCar.

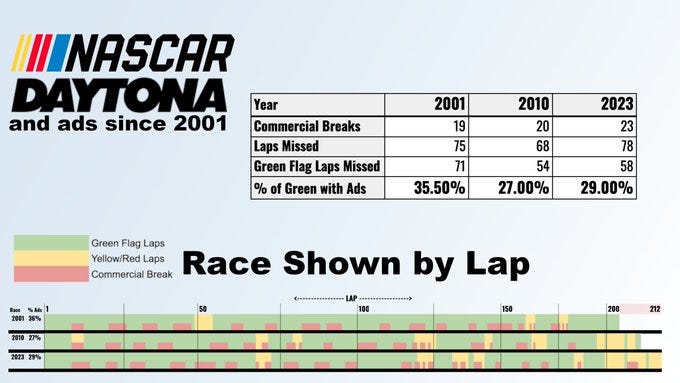

Let’s visualize one of the largest US races; the Great American Race, or NASCAR’s Daytona 500. This graphic breaks down the commercial breaks coupled with nearly 2 decades of races since it debuted on FOX.

No matter the race–IndyCar is no different–commercials are intertwined to the detriment of the viewer with almost 30% of the race being commercials. If a race lasts 4 hours; that’s over an hour of mind-numbing commercials.

Sorry Flo, I don’t need to bundle my insurance, you’re wrong about “great coverage” Verizon, and the last thing on my mind for breakfast will always be Taco Bell.

When NBC declined to renew their broadcast rights in 2017, F1 sold those rights to ESPN dirt cheap for only $5M. ESPN quickly put forward a commercial-free strategy they hoped would prove a “differentiator” in its attempts to boost its new F1 property.

It was gorgeous. Heaven for a rabid sports fan like myself.

When I sit down to watch a race I know I’m going to get 2 hours of racing and not have to listen to a single pharmaceutical company’s disclosure on their seemingly horrid side effects the entire race.

No distractions, just wheel-to-wheel combat at unimaginable speeds. The icing on top is the celebs, team strategy, global audience, and Martin Brundle’s brutal color commentary.

I absolutely love it and it seems I’m not alone as ESPN’s strategy worked, in 2021 alone, F1 ratings were up 40%.

In 2022, F1 debuted the new Miami Grand Prix. ESPN's coverage of it broke F1's record for the biggest US audience ever, at 2.6 million.

After a war with Amazon and a humiliated NBC, ESPN re-upped their rights for $75-$90 million a year vowing to keep race telecasts free of commercials as part of the deal.

Hallelujah, US F1 fans rejoiced.

As long as this strategy continues it will provide a strong tailwind for the US F1 popularity explosion.

More sports should take note, especially American motorsports properties, and figure out how they can incorporate the commercial-free experience in their TV rights.

It's exciting to see F1 gain popularity and new fans in America year-over-year. Hopefully, more sports will follow suit. Not that I'm an expert on sports marketing, but I think baseball and American soccer could use some of that flywheel momentum.